At first, headlines as this one looks like a little bit abstract for us, but these problems are things that we should have in mind, we should know how to discuss it and have a critical look at it. Have you ever thought about if you had to pay almost a 100% of your incomes to the State and in return don’t receive a good Medicare, social care or Medicaid? That’s what I’ll talk about in this post and by the way, I suggest two interesting contents: : I.O.U.S.A (Movie) and the book: Empire of Debt by Bill Bonner and Addisom Wiggin .

I begin this post with an interactive chart from Financial Times, click here to see the chart. We can see that public or federal debt in US in 2007 was around 42% of GDP and can hit 85.5% in 2015. Do you think this is comfortable? In 2007, the Japanese federal debt was around 81.5% of the GDP and can reach in 2015 the mark of 154.7 % of the GDP.

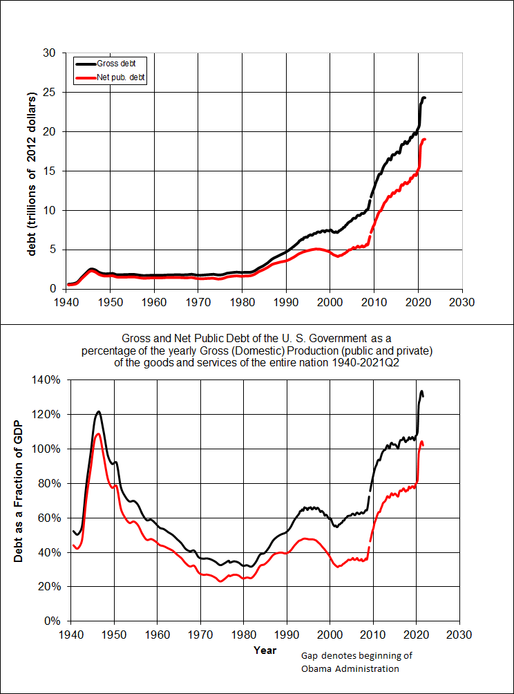

The federal debt occurs when the outcomes are bigger than the incomes and we express that result as a percentage of the GDP. The increasing or decreasing in this number depends on the monetary policy the country is using; it can be a contractionary, expansionary or neutral policy. People say that public deficit is used to stimulate the economy so in the future the country can enjoy that result. But, are we prepared to that supposed future? Take a look at the U.S gross and public debt chart. Do you think that this is healthy?

Now, take a look at it :

The Greece debt is more than 100% of the GDP. That's not healthy and that's why the government is heading for austerity measures. France government is doing that too, the country is set to raise the national retirement age in a bid to overhaul the nation’s government-run pension system and restore its ailing public finances, according to European Institute.

The most dangerous problem is realated to the ageing of the world population because this can represent a potencial meltdown of any nation.

Why this can mean a meltdown for any nation? Just take a look at that picture above and you will going to see for yourself. As the population get older, the government will colect less and will have to pay more for those people who contributed for the previdence all their life. More retirees means more spent with healthcare, how the governments will pay for it if he will receive less than before? Don't you agree that people can have less quality of life? Don't you think the government will rise taxes to equalize the bill? Today, most of government in the world are having a surplus in their social security but, is this going to continue? Think about it!

As you can see in this video, people is so used to spend their money buying a lot of things that they forget about what and how things will be in the future. I suggest this book in order to know more about the "consumerism": "The System of Objects, For a Critique of the Political Economy of the Sign, and The Consumer Society - Jean Baudrillard". The concept of sacrificing and building for a better tomorrow had been pushed a side by a live for today, easy credit and consumption order society. That's what I don't understand. People are thinking about just in themselves. Savings results in an increase in investment, additional research in development, a strong economy and a improve in the overall standard of living.

There are three types of people in this world: Those who save and invest, those who could easily save more but choose not to and those whom savings is very difficult. But who is the most injured when we talk about inflation? When the inflation rises people who are less well off will suffer more.

...

"So in that sense, if fiscal policy is lax or savings are exceptionally low, there is nothing monetary policy or any central bank can do about that. We cannot live in the present only, human beings cannot survive unless they create prevision for their future" - Alan Greenspan.

so...

Now I have one more question I would like to talk about. We already talked about public deficit, savings deficit and now I would like to talk about the trade deficit. What is this? "An economic measure of a negative balance of trade in which a country's imports exceeds its exports. A trade deficit represents an outflow of domestic currency to foreign markets." - Investopedia.

Take a look at the U.S trade deficit ticker here: http://www.americaneconomicalert.org/ticker_home.asp

In 2007, U.S was the last contry on a list of Trade Balance, it means the country had the worst trade deficit in 2007, but on the other hand China was the first at that list, according to the CIA World Fact Book.

If you are buying more than you selling, your trade partners are going to own a lot of your wealth. When a country has a low savings rates and the government has to borrow money to pay their bills, the trade deficit can be problematic.

|

China is the second larger holder of U.S treasuries and it is dangerous because it concentrate power in China's hand. If they would like to liquidate those treasuries, it would be a caos all over the world. Now take a look at the major foreign holders of U.S trasury securities here. So, are you still thinking that we just have to live the present? Aren't you been selfish? What about your kids? Think about it (again). |

No comments:

Post a Comment